)

Another decimal point

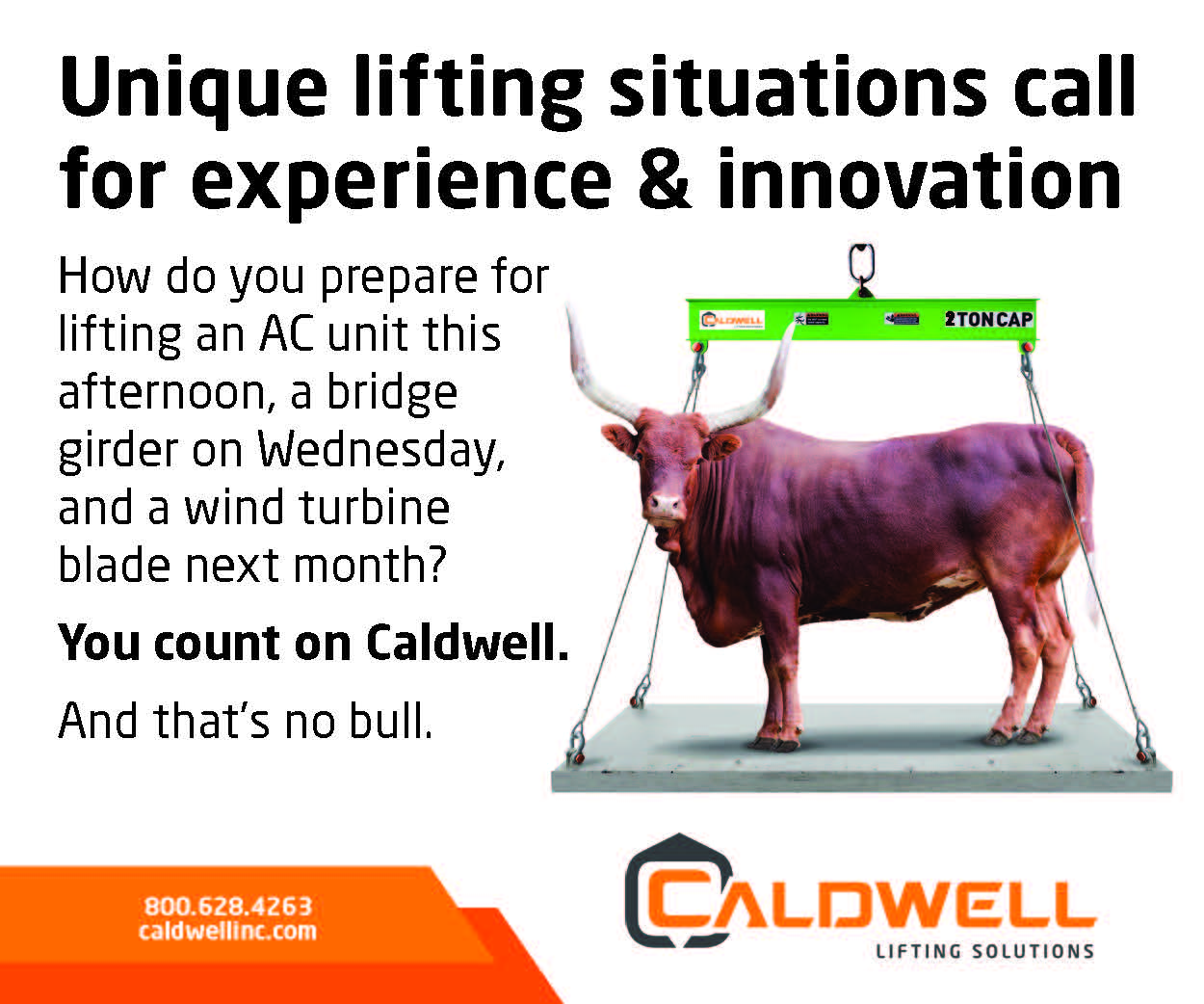

How can we stage a long-term, sustained recovery after two lightning strikes? Doug Stitt, president and CEO at The Caldwell Group Inc, went looking for the answers.

Someone once suggested to me, that if we don’t know where we’ve come from, we won’t know where to go. I guess there’s something in that. So, let’s chart the journey from the time when this magazine was launched to present day before we gaze into our crystal balls.

The last 10 years was bookended by two big shocks, with periods of normality and prosperity in between. For many, at the turn of 2012, positive signs had become upward trends, as sectors bounced back from the financial crisis, while those that depended heavily on construction were still reeling as global markets recovered. Fast-forward 10 years and we’re now looking for green shoots and hand-holds again, this time following a worldwide pandemic.

The difference in our mindsets now is that once lightning has struck twice, we know it can do so again. One blow can be a sucker punch but two is a fight, which is how business will be approached from now on. Many people are resigned to the inevitability that there will always be something to overcome if they are running a business. Whether that’s a financial crisis, global pandemic, major climate event, or geopolitical situation, there will be macro issues dramatically influencing the landscape.

This mindset is the real legacy of the pandemic; it’s the business world’s long Covid. This isn’t only because of its economic impact, but because it’s hit us all personally in ways another crisis can’t. The Great Depression (1929 to 1939) and the Spanish flu (or Great Influenza; 1918) are still often referenced today despite happening so long ago. My grandparents were products of the depression and their memories and behaviours over the rest of their lives were formed by what happened during that period. Covid will be the same, I fear. Worse is that these days, social media and the viral nature of news magnifies everything a thousand times, so perspective is lost. Things are harder to forget and move away from too.

Think Lifting

Consider that we were already battling with a labour crisis even before the first reference to Coronavirus. While robots and automation are proving to be more than just buzzwords, human labour remains the lifeblood for many businesses, like mine. What’s worsened over the Covid era (two years and counting) is that not only has our skilled workforce aged a bit more, but I sense a loss of desire in people to acquire the necessary expertise to take industry forward. The first problem is based on a systematic function to help develop those types of skills and experience; the second is based on a population’s movement away from the inclination to acquire that information and work in certain fields.

Using the US as an example, the systems to help younger people move into jobs that involve trades and industry skills began to erode in the 80s and, despite political rhetoric that we need to re-grow manufacturing or re-shore jobs, there has never been a serious, sustained programme to do this, such as having a comprehensive, national manufacturing strategy.

With every recession or correction, more skilled people leave these jobs, and more folks retire. Incoming workers have long turned away from the trades and hard skills, choosing to work in other segments of the economy that are more service related. The Lifting Equipment Engineers Association’s (LEEA) Think Lifting campaign is a good example of the plea to a variety of audiences to recognise the importance and breadth of what we do and help develop solutions for large challenges—such as labour.

Encore

Now for the part I think most people are most interested in: what can we do to ensure it’s a bright, productive, safe, happy, future? Not much to ask for, right?

Well, if you like choice, capability, growing standards, heightened safety, and further improvement of best practices, it could be the decade for you. We’ll certainly see the refinement of standards across the world, which will drive more emphasis on training and certification. In the US, for example, trade association, Associated Wire Rope Fabricators (AWRF) is partnering with LEEA to develop a certification programme for the rigging industry, with the hope of spreading best practices and recognising those that become certified.

I’m also excited to see what the next 10 years has in store in terms of equipment and technology. New materials, vision, automation, speed, data, etc. all present a small preview of what is to come in our industry. I believe it’s an inherent responsibility in every sector to work to improve the safety and efficiency that can be achieved. Improving technology continues to add to a manufacturer’s toolbox, giving us the ability to provide a broader array of products and capabilities to the point of use. With the growth of technology, expanding materials, science, and continued globalisation, expect to see lightweight, smarter products becoming more available across broader markets.

These trends dovetail somewhat with our conversation about skill shortages. Technical resources, like engineering, have a more stable outlook than traditional, skilled trades, but developing industry and application-specific knowledge is still a challenge. Someone might be able to draw-up a lifter but understanding how that product is employed below-the-hook of a crane is another matter. Moreover, we need to know how this application fits a wider production cycle.

Green fingers

You can’t talk about the future without referencing renewable energy and carbon neutrality. Green initiatives at the very least mean our industry will be providing solutions to different applications and businesses. Specifically, Caldwell sells a variety of products and solutions to these growing sectors, such as wind, solar, and battery-powered vehicles. It will also mean selling solutions to existing, traditional customers that might be looking to produce, say, carbon-neutral steel. As manufacturers, we need to continue to look at what we do and how we manage our footprint.

The demise of oil and gas has been proclaimed (over and again), yet we’re now facing a winter of discontent, due to energy prices and availability. We need to be a little more rational about oil and gas – the outlook is somewhere between the extremes. Oil economies, like Saudi Arabia, wouldn’t be looking as seriously about diversifying their economy away from fossil fuels as quickly as they are without alternatives, but it’s also not going to happen overnight. During my lifetime, every energy cost spike has been met with a rush for change, but when gas drops, the replacement option falls to page six in the newspaper (or digital publication).

With greater certainty, fragmentation within the lifting industry as well as financial engineering will continue to drive consolidation. The shrinking trend of sole-proprietor and family-run, private businesses will energise this activity. As older generations that started operations in the 40s, 50s, and 60s choose to exit, for a variety of reasons, the primary buyers are larger firms looking to roll them in to create more scale. These buyers tend to be financial in nature, backed by private equity, and require growth beyond that which is achievable organically.

Dance to the tune

Be warned: there’s such an orchestration with global supply chains and the flow of goods that it will likely be 2023 or longer before flows really stabilise. Efficient markets don’t create and operate at significant capacities above what is needed in a relevant time. Therefore, it will take months for resources to become rebalanced.

Take the Port of Long Beach, for example: they have operated well considering the huge amount of traffic that flows through it. But since the dominos fell across the supply chain and their flow backed-up, it is taking many months based on their existing capacity to consume the huge spike in demand they now face. Of course, that relates to all the infrastructure that supports the port: trucks, rail, etc. And all of it must continue to dance to the tune of a pandemic.

That same scene is playing out across the world as countries and their resources are in some cases struggling to get goods out, while others are struggling to get them in. These trends might lead to the re-shoring of certain items or industries, but there are significant challenges to that as well. In other words, the pandemic may mean businesses will limit their reliance on global supply chains, but overall globalisation and global supply chains will continue growing.

Supply chains exist within a single company’s route to market too. Caldwell, like many companies in our sector, provides product through regional distributors. These channel partners face the same questions and challenges we all do: what value do you bring? As the landscape continues to shift and change, we all need to actively define and re-define what value we present to the marketplace and its customers.

Running a supply chain

Using an example from retail, someone looking for Nike shoes in the past would have travelled to a retailer known to have Nike shoes. Now, many of Nike’s customers can visit Nike.com from the comfort of their home to browse new gear online, find something specific, or even buy highly-customised products. This democratised change has forced Nike’s channel partners to re-evaluate the value they bring to stay relevant. Today’s environment requires the same kind of evaluation for all businesses.

Generally, ecommerce or self-help tools were already growing year-on-year but Covid has been a huge accelerant. I still believe, though, that it’s important for companies as they pursue online service models to maintain a level of humanity and customer friendliness. Many companies, like Amazon, are offering great online experiences but with no hope of human interaction, even if the consumer chooses it. Perhaps at their scale it makes sense but for other firms, the ability for people, at least for now, to choose the level of human versus electronic interaction is important.

I covered our industry’s ascent in the technological sphere and, combined with more online activity, expect to see the type and value of items consumed via the ecommerce model evolve. At a higher rate of change, complex products will be easier to configure online or at least to a point where they can easily be fine-tuned into something that can be fully defined with a reasonable amount of work between sales, engineering, and technical teams.